DPM Lawrence Wong at the Economic Society of Singapore Annual Dinner 2023

PM Lawrence Wong

Economy

Finance

26 September 2023

Speech by Deputy Prime Minister and Minister for Finance Lawrence Wong at the Economic Society of Singapore annual dinner on 26 September 2023.

This article has been migrated from an earlier version of the site and may display formatting inconsistencies.

ESM Goh Chok Tong,

Professor Euston Quah,

Excellencies and Distinguished Guests,

Ladies and Gentlemen,

Thank you for inviting me to the Economic Society of Singapore’s annual dinner.

As Euston said just now, my first job in 1997 was a research economist at MTI. So it is certainly good to be in a room with fellow economists and to see many familiar faces.

I did a lot of work on macro-economic modelling when I started work – forecasting GDP growth, analysing the impact of exogenous shocks on the economy. That was my bread and butter.

I enjoyed the work, but after a few years, I started feeling restless; I thought about joining the private sector, but later I thought maybe I should stay on, go beyond analytical work and get more involved in policy deliberations that could influence our economic and social outcomes.

Since then, I have pursued this path as my life calling, initially as a civil servant and now in politics. That means focussing all my efforts to continually think about how we can keep our economy strong, and to create good jobs and better lives for Singaporeans.

We all know that there are significant challenges in the road ahead. In the external environment, we have the war in Ukraine; deepening geopolitical rivalry; as well as changes in the global trading system.

Domestically, we will run up against more binding constraints in land, labour, and carbon. Our population is ageing rapidly, and more resources will be needed to meet our growing healthcare and social needs.

All this has serious implications for Singapore and our future growth prospects. Some people think that the Government is overly obsessed about growth, and we just want to grow at all costs. But that is not true.

Our focus has always been to grow the economy, not for its own sake, but as a means to improve the lives of everyone in Singapore. We are also realistic about what will happen if our economy shrinks: people will lose hope about the future; the lower-income groups will suffer the most; and cohesion and trust in society will start to fray. We have already seen this happen in many other advanced countries, and we do not want this to happen here in Singapore.

So tonight, I will focus my remarks on how the Government plans to deal with the twin challenges of inequality and mobility, especially in a more challenging environment. We have been thinking hard about these issues as part of the Forward Singapore exercise, and we aim to wrap up the exercise and release the final report soon. So what I am sharing with you tonight, exclusively for economists and the ESS, is a preview of some of the recommendations and ideas in this upcoming report.

Advancing the Well-being of the Broad Middle

Our first imperative is to advance the well-being of the broad middle in Singapore, to help them secure jobs with good salaries and enable their real incomes to grow – not just nominal, but real incomes. Only then will they be able to tackle concerns over their cost of living, and enjoy rising standards of living over time.

The best way to achieve this is through a strong and dynamic economy. That means we must stay open to the world, and build on our competitive strengths to attract quality investments and scale up our own homegrown enterprises.

Having more high-value and productive companies in Singapore translates to better prospects for the broad middle. Look at the middle-income workers in Singapore over the past decade: a large proportion of them enjoyed upward income mobility.

When we drill down further into the data, we find that many had in fact switched jobs. They moved to work in more productive firms, typically in a larger local company or a Multi-National Enterprise.

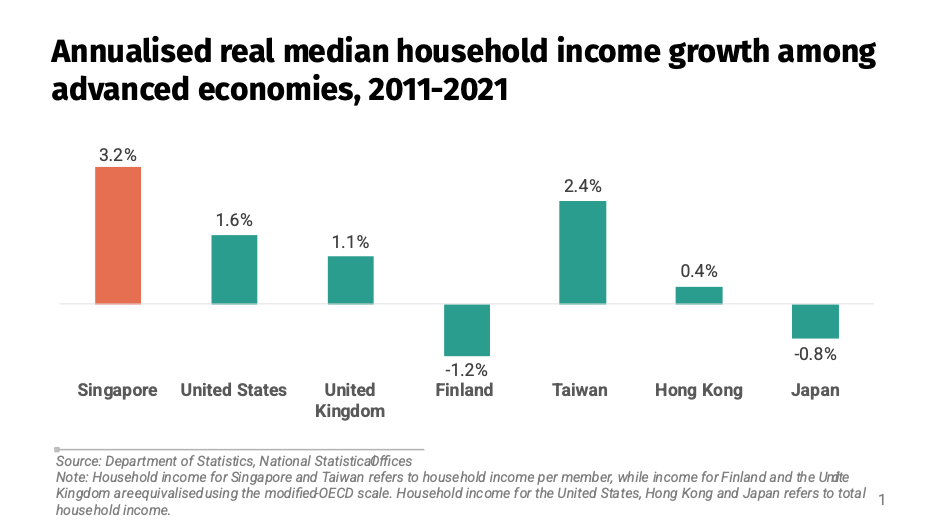

That is why our median household income growth in Singapore over the last decade has been very strong compared to other major advanced economies, like the US, UK, and Finland1.

So when we have a strong economy, when we have productive firms and when we have workers working in these firms, they enjoy good income growth.

Amidst tighter resource constraints, we will no longer be able to achieve effortless growth in Singapore. There will be more binding constraints on us, more trade-offs. It simply means we have to work doubly hard on economic restructuring, and allow the forces of creative destruction to work through the economy. Government policy should facilitate this, and not inadvertently prop up non-viable activities with low productivity. The churn will be painful and it has to be carefully managed. But it is essential, so that limited resources – be it land, labour or carbon – can be channelled to more productive areas. So this is our imperative in order to uplift and advance the well-being of the broad middle.

We will need to work on business-level productivity. We also should continue to focus on the microeconomic logic of policies, whether it is congestion pricing or taxing carbon emissions. Because all this ensures that scarce resources are allocated efficiently, and they contribute towards more productive outcomes.

Over the last decade, from 2012 to 2022, our Total Factor Productivity, or TFP, grew at around 0.4% per annum. That is comparable to other advanced economies like Canada, the US, and the UK2. But we must strive to do better, and further improve our TFP over the coming decade.

Technology will be a key enabler. By leveraging on new, game-changing technologies like generative Artificial Intelligence (AI) across our economy, we can drive innovation, productivity growth, and ultimately incomes, for our next bound.

But every new technology wave brings about considerable disruption to workplaces and to jobs, and this will have to be carefully managed.

This is not new. I remember in the early 90s, the changes in workplaces when personal computers became widely used. My mother was then a teacher, and she was very attached to her typewriter. All her work, exam scripts – everything was done on the typewriter. She found it very hard to adjust to using a computer. I could not quite understand it – typewriter, computer, seemed the same. But it was difficult for her. I tried to help her – maybe I was not such a good teacher – but she was never fully comfortable, and she eventually opted for early retirement at 55. That was the computer wave.

The disruption from AI will be even greater than what we had experienced back then. When I speak to CEOs of large firms, here and globally, they tell me their plans to use generative AI to drive greater efficiencies and transform their operations. This is not something that is going to happen in the distant future. It is already happening now, and the momentum will ramp up in the coming years. Many more workers, including PMETs, will find their existing job roles becoming obsolete. There will still be new jobs created and other opportunities for these workers. But it means everyone will have to be better prepared for multiple transitions in their careers.

Older workers in their 40s and 50s are especially vulnerable. Many also have caregiving obligations, which can make it difficult for them to set aside sufficient time to meaningfully refresh their skills.

The Government will therefore need to do more to help our workers adjust to this quicker pace of change and churn in our economy.

We have already been investing heavily in lifelong learning and reskilling through SkillsFuture.

Since we launched SkillsFuture in 2015, Government spending on continuing education and training has almost doubled to nearly $1 billion this year.

But we can and we will do more.

We therefore plan to step up investments in adult education and training, and significantly strengthen SkillsFuture as a key part of our social system. Some areas we are looking at include:

Top-ups to the SkillsFuture Credit for mid-career workers.

Training allowances for mid-career workers who take time off to pursue full-time training, such as longer-form courses. Because when you take time off, not just for one, two days, but for months, who is going to pay your salary? So, training allowances will help them pay their bills while they take time off to study and to get a significant new injection of skills.

Support for career planning and guidance, so that individuals can proactively improve their career progression prospects and resilience.

Better job matching, to help workers move into jobs that better utilise and reward their skills.

We will also build on this revamped SkillsFuture system to provide support for workers who are involuntarily unemployed.

For a long time, the Government has been very cautious about introducing unemployment benefits.

For good reason. We’ve seen the experiences in other countries where automatic unemployment benefits led to negative outcomes – those who receive such generous benefits find it more attractive to stay unemployed rather than get back to work.

But looking at the faster pace of change and churn in our economy, we have revised and refreshed our thinking.

We don’t have to do this as an insurance scheme. Instead, we can have a Government-funded benefit, appropriately sized, to help these workers tide through their immediate difficulties – while supporting them to continue with their upskilling and job search, and eventually bounce back stronger.

So that's something we are working on too, and this will be part of our expanded SkillsFuture system.

This is how we will continue to advance the well-being of our broad middle in Singapore – by giving them maximum support to stay relevant and competitive in their skills, and to take on new and better jobs in more productive companies throughout their careers. Through these efforts, we can ensure that the majority of Singaporeans enjoy continued increases in their real incomes and living standards.

Tackling Inequality & Uplifting the Lower-Income

Our next priority is to uplift those in the lower-income segments, and make ours a fairer and more equal society.

We are not doing too badly on income inequality. Our efforts over the years to uplift lower-wage workers have had a positive effect.

Government moves like Workfare, the Progressive Wage Model, and the Local Qualifying Salary for companies that hire migrant workers – all of these different moves have all helped to ensure healthy income growth for our lower-wage workers.

Over the past ten years, real income growth for workers at the 20th income percentile has risen faster than for those at the median.3

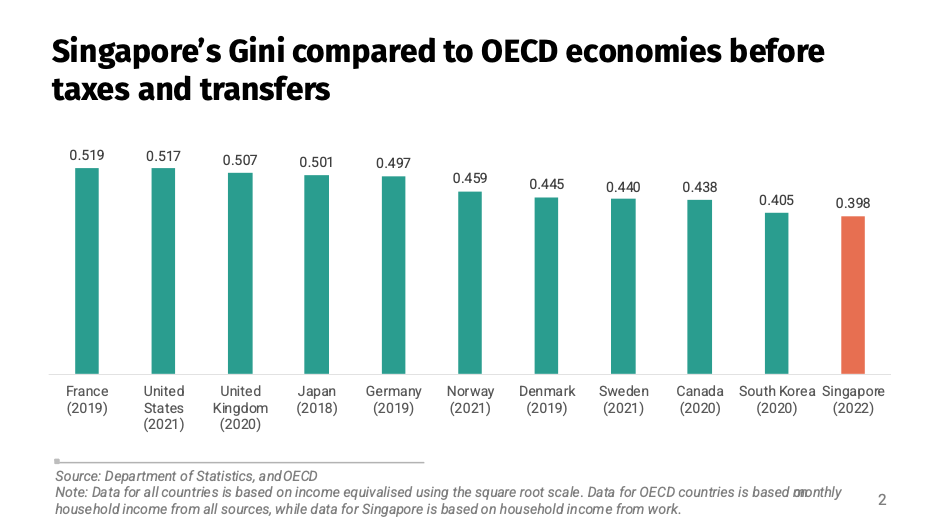

As a result, our income inequality, as reflected in the Gini coefficient has declined steadily over the past decade. Some people say that income inequality has gone up, but actually, as measured by the Gini coefficient, it has in fact been coming down steadily over the past decade. Our level of income inequality is on the lower end of the range among advanced economies, before taxes and transfers are taken into account4 as you can see from this chart.

After taxes and transfers, our income inequality is about the same as in places like the UK, and lower than in the US. We are nowhere near as equal as the Nordic countries and several others in the advanced world, that’s true – but in these places, they have very high income and value added taxes in order to achieve lower Gini coefficients. And these high-income and high value-added taxes apply not just for the very top, but also for the middle-income. We have in contrast, kept the overall tax burden relatively low for the vast majority of workers in Singapore.

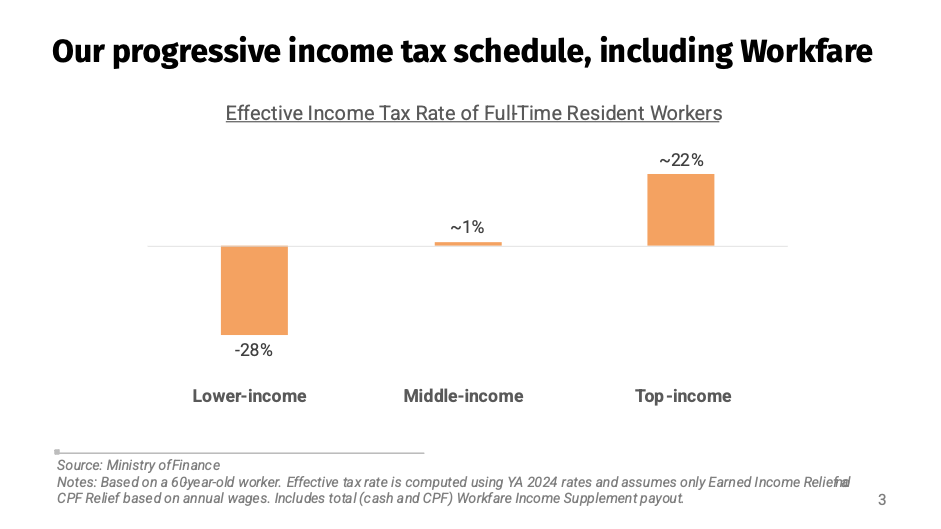

Our fiscal system is also highly progressive. Take income taxes as an example. Our top marginal rate is 22% and will be raised to 24% in 2024. But our income tax schedule is also complemented by Workfare. If you are older with lower income, you can get an additional income supplement of up to $4,200 per year from the Government. Which means our effective income tax schedule is around 50 percentage points wide – from 22% for the top income earners now, going up to 24% (next year), all the way down to as low as negative 28% for our senior lower-income workers.5 It's a very progressive schedule. That's for income. We will continue to work on income inequality and make progress.

We are also paying attention to wealth inequality. That’s another source of inequality.

Ideally, we would like to tax the net wealth of individuals. Certainly, MOF would like to do so. But it is very difficult to implement this effectively, because financial wealth is very mobile and difficult to track. Every country faces this problem, not just Singapore.

So what’s our next best option? We have instead focussed on taxing property, which is a key source of wealth for many in Singapore. We recently increased our taxes on higher-end properties significantly, through higher property tax and stamp duties.

Some Singaporeans say they are asset-rich but cash-poor. We understand. We all know of retirees who live in a private property, and are worried about having insufficient income to meet their daily needs. That’s why from time to time, the Government will extend support for this group – e.g. we cover many of them through one-off support measures like the CDC vouchers. That's given to every household regardless of your housing type. And a number of them living in private properties also receive the permanent GST vouchers, so we have not left them out.

In fact, the recent property tax changes which we announced in the Budget will impact owner-occupied properties with Annual Values of more than $30,000, as well as those which are non-owner-occupied. For those who own non-owner occupied properties, I think if you can purchase more than one property, you pay your share of taxes. If you’re staying in an owner-occupied property, it applies only to those with AV>$30k. AV is a very complex and difficult concept for people to understand. I am sure if I were to ask you what is the AV of the home you are living in, no one would know. How many of you know the AV of the home that you're living in? But if I asked you what's the price of your property, I would bet you know the answer, right? Well, these two concepts are related. It's just that we use AV for calculating property tax. And if you are lucky enough to live in a property with AV>$30k, it’s very likely to be a higher-end condominium or a landed property worth more than a few million dollars. That's what it comes down to. That's not a small asset by any means. And those who are prepared to right-size will be able to unlock a sizeable amount of wealth for their retirement. Or they can choose to stay in the same place, and monetise part of their home asset through a home equity loan, offered commercially by financial institutions. Nevertheless, we are reviewing and studying how these schemes can be made more accessible and attractive to seniors preparing for retirement.

While we tax the wealthy, we also help the lower-income build up their wealth, for example through the generous subsidies for the lower-income to purchase a HDB flat, as well as more support for those with lower CPF balances. These are mechanisms for wealth transfers, enabling us to help the lower-income segments purchase their own homes and build up their nest eggs for retirement.

We will continue to review and enhance our schemes to uplift the incomes and wealth of the more disadvantaged groups, and close our income and wealth gaps over time.

We are focusing on one key segment, which is our ITE students and graduates.

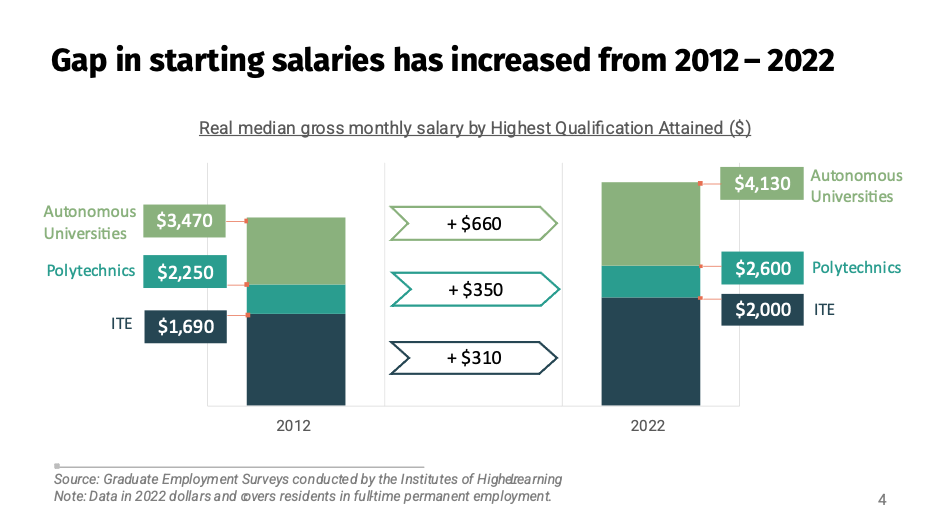

There has been a growing divergence between the starting salaries of graduates from ITE, Polytechnics, and Autonomous Universities over the past decade6. Their starting salaries have all increased meaningfully over time in real terms, but those with higher qualifications, especially our University graduates, have been pulling further ahead.

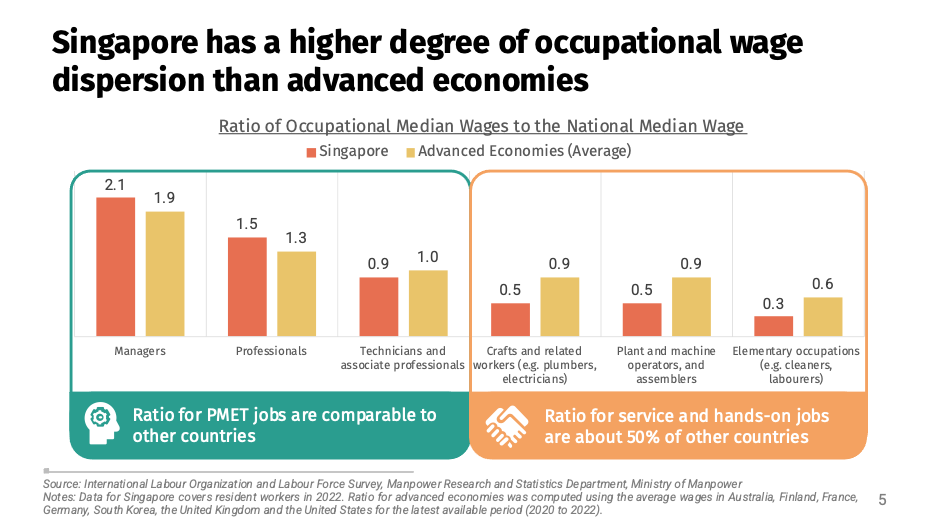

It is not surprising. It reflects the college wage premium that exists everywhere in the world. But the college wage premium is probably on the higher side in Singapore. This shows up in our economy too. It is reflected in the occupational wage disparities7 between those who engage in more knowledge-based, or “head” work, like managers and professionals, versus those who engage in more “hands” and “heart” work, like technicians and service workers.

Look at this ratio of median occupational wages against the national median wage. In other words, this reflects how much a certain occupation earns compared to the median worker. For our PMEs – professionals, managers, executives, the ratio is broadly comparable to other advanced countries’. But for service and technical hands-on roles, our ratio is about half that of other countries.

To be clear, we will not be able to completely remove wage disparities in the economy. But too large a wage difference will create problems. It is partly the source of education anxiety and stress as well, because parents and children worry about getting to the ‘right’ pathways that will lead to the ‘right’ jobs for the future.

We must do all we can to reduce these wage gaps, encourage more diverse pathways, and instil dignity and respect for every job, every vocation, and every skill.

We will do this industry by industry – redesigning jobs, raising productivity, upgrading skills, and establishing better progression pathways. We have made good progress in certain sectors like pre-school education and nursing, and we are looking at how we can do the same for other services and professional trades. With these industry efforts, and working closely with our educators at ITE, we aim to push up the starting salaries of our ITE graduates.

At the same time, we will help our ITE graduates upgrade their skills over time. They could enrol in a work-study diploma or a part-time diploma and gain industry-relevant skills. When they do so, preferably early in life, they get onto a better career progression pathway, with bigger job roles and better pay. So we will also think of ways to do more to help our ITE graduates in their upgrading journey.

Of course, the Government cannot do all these singlehandedly. It will require all of us – as employers, also as consumers – to recognise the important work that our fellow citizens undertake to keep our society going, and do our part to uplift their progress. All will gain when even the most vulnerable among us become better off. We will become a better people, and a more just and equal society.

Enabling Social Mobility, especially for the Disadvantaged Groups

Third, even as we close inequality gaps, we must ensure that our society remains socially mobile.

Our relative social mobility remains higher than in other advanced economies. This means that if you were born in the lower income segment, the chances of you getting to a higher income group is still quite good, here in Singapore. But focusing on relative mobility has its limits. There is a tendency to look at it as a zero-sum game – because when someone goes up, someone else has to come down. What is more important is to ensure absolute mobility, so that everyone keeps moving up. In particular, our focus should be on children from more disadvantaged and vulnerable backgrounds, so as to prevent inequalities from being transmitted to the next generation.

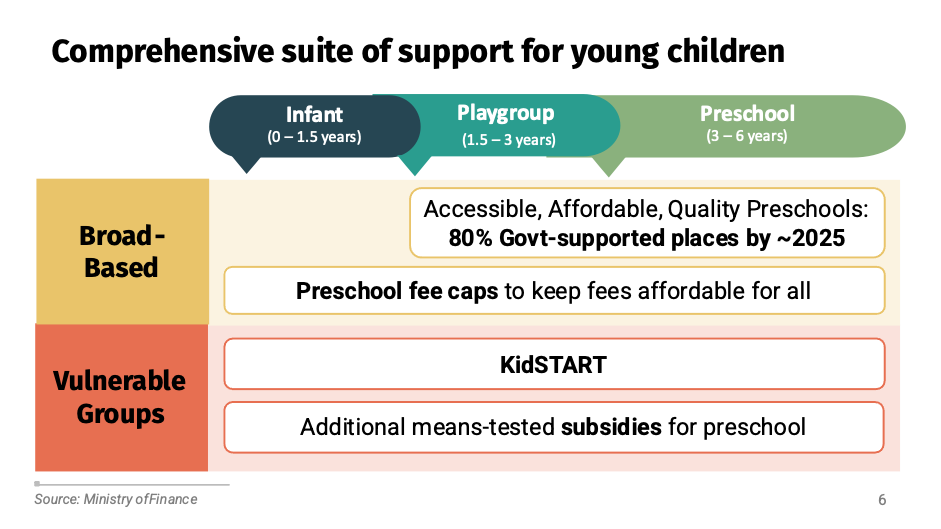

We know that the early years are critical for a child’s development, and that is why the Government has invested significantly in this area. We have a whole range of different programmes now – KidSTART, to equip and engage lower-income parents with the knowledge and skills to support their children’s development, and to address learning delays and health issues early on. We have expanded affordable and quality pre-school places substantially over the years, with more subsidies going to the lower income segments, and we will continue to spare no effort in ensuring every child has a good start in life.

We are also making a concerted effort, through something called ComLink, to provide more holistic support to families living in rental flats with young children. We are taking a family-centric approach, where case workers and befrienders come together to support every family, one by one – find out their concerns, and see what we can do to better support them.

It requires a lot more work and effort on the ground because we know that the issues that these families face are very complex – there may be marital stress, addiction problems, bad debts to resolve, or even motivation and self-confidence issues to address.

Making progress on all these issues is not just about giving more financial transfers; it often requires very intensive engagement and ‘hand holding’ by the case workers. Volunteer befrienders also play an important role because they can help to talk to the parents, serve as mentors to the children, give them access to opportunities and networks, and provide them with good counsel and advice. We have to be realistic about what we can achieve in the short term. But in the end, this is the best way to encourage and empower families to achieve success and to sustain their progress.

One way to better support this work is to provide additional support that is tied to specific action plans that the families themselves take responsibility for. Because we want these families to feel empowered in taking active steps towards achieving their own long-term goals, like staying employed, getting a good job, saving to buy a home, or ensuring their children attend preschool and school regularly. If families take steps towards these goals, then the Government could provide them with higher and longer-term financial payouts. This can help reduce their short-term financial pressures, while reinforcing their efforts to improve their life circumstances.

Nurturing a Culture of Philanthropy & Giving Back

So far, I have spoken about supporting the broad middle and uplifting the lower-income. What about those who are better off?

Take for example the top 20% of households in Singapore. The 80th percentile earns close to $20,000 a month for a 3-person household.8 In fact, that puts our high earners within the top 5%, and some possibly even in the top 1% globally in terms of income.9 So this group has done very well for themselves. They are undoubtedly talented and hardworking, and they have been well rewarded for this.

But like all groups, the higher income segments also face their share of stresses. Some of these pressures may arise because people compare their lot with that of others.

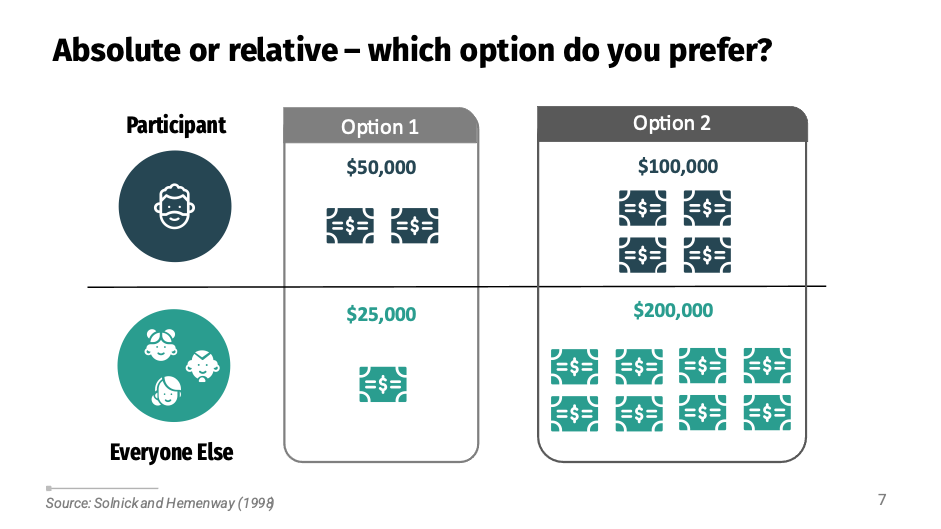

I am reminded of a study10 done in Harvard in the late 1990s – participants were asked to choose between two options: first option – you can earn $50,000 a year but everybody else gets $25,000; second option – you earn $100,000 a year, everybody else earns $200,000. Which will you choose? Option one or option two? If we do a poll in this room, it would be very interesting.

Because as economists, you should know that the rational choice is option two. $100,000 is more than $50,000.

But interestingly, in the survey, the majority preferred the first option. They were happy with less, as long as they were better off than others. I earn $50,000, but everyone else earns $25,000. Forget about the $100,000. This is not just unique to this survey. Other studies have shown that people are often more concerned about their income relative to others’, than about their own absolute income. Happiness at your own pay vanishes very quickly when you learn that your colleague has been given more.

The implication is that beyond a certain point, more money does not automatically make you happier. In fact, if the chase for more material success is motivated solely by social status and peer approval, it will be self-defeating. You may make more money, but because others do as well, you will never feel happier, and you just keep on going on this endless rat race. A better way is to focus on your own life goals, and succeed on your own terms. There is no need to feel trapped by hyper-competitive social norms, or get caught up in an endless rat race simply to outdo the people around you.

In fact, the top 20% of Singapore’s society is already today the largest contributors to tax revenues. Understandably, they sometimes feel that the Government is not doing enough to help them. But if you look at the broader picture, their tax burden is significantly lower than what they would be paying in most other cities or countries. For the relatively low amount of taxes paid, they enjoy many benefits in Singapore – a clean, green, orderly, and stable society that works; excellent public infrastructure; good schools and tertiary institutions with highly subsidised fees; and opportunities aplenty for them to excel.

These are not small things. From time to time, you come across people who mistakenly attribute their success entirely to their own efforts and hard work. But we must remember that a large part of our success is down to the society we live in – it is because we operate in a Singapore system that we are able to thrive and excel.

The bottom line is that no one succeeds alone. We truly succeed only when we succeed together as a society. So those who have done well in life should feel a sense of responsibility to do their part and help uplift their fellow citizens. Some of this will indeed be achieved through taxes and Government transfers. But if everything is done through the fiscal system, we end up with high taxes not just for the top, but for the broad middle too. More and more things will be done by a state administration, which can never match the compassion and personal touch that community support provides.

So we should do more to strengthen our culture of giving and philanthropy in Singapore. This must be an integral part of our system, and a key feature in our social compact, which is individuals here, Singaporeans, enjoy the opportunity to generate and accumulate wealth, but part of that wealth must be recycled and invested back into society to expand opportunity for others.

In Singapore, the legacy of our early philanthropists like Tan Tock Seng, Lee Kong Chian, Syed Omar, Hajjah Fatimah, just to name a few, is still keenly felt today. Philanthropic giving in our society has been on the rise, but compared to other countries like America, we still have some way to go. In Singapore, and across all Asian countries, there is a deeply entrenched mindset to bequeath wealth to the next generation within the family. In America, the wealthy are more prepared to give away the majority of their wealth to charity. As one of their billionaires said, I do not want to deprive my children of the opportunity to make their own money, so better give most of my wealth to charity instead.

We ought to re-examine our own attitudes, and consider ways to strengthen our philanthropic culture. It is good that as Asians, as Singaporeans, we want to look after our own families. But perhaps we should look at family in a wider context – not just our children or our grandchildren, or even our immediate relatives, but people in our wider community, everyone who belongs to our Singapore family. Over time, I hope many more in Singapore who have done well for themselves will set aside larger and larger proportions of their wealth for our broader Singapore family.

These contributions go beyond financial donations. They can adopt causes they feel strongly about, and work with the Government on social initiatives that make a difference.

Our efforts to build a fairer and more inclusive society cannot be limited to just monetary redistribution by the Government. It must involve the community – to engage the human spirit, to provide personal fulfilment, and to strengthen collective well-being. It must strengthen the culture of responsibility for one another, so that we all feel a sense of duty to each other and not just a right to the benefits of citizenship.

Conclusion

To conclude, these are some of the key ideas for Forward Singapore. Not comprehensive, but certainly some of the key ideas we have developed. This is an agenda for our next phase of nation building, which has been co-created and shaped together with the many Singaporeans we have engaged over the past year. We want to ensure that Singapore remains a place where everyone can progress throughout life, and forge fulfilling and dignified lives, with greater assurance for today and for tomorrow.

To realise these shared goals, we will need to change and do some things differently, and I have shared some of these changes earlier. We will also need to hold firm to some core values and principles – like our strong sense of kinship and trust in each other, our close tripartite partnerships, and above all, our enduring belief that we are one united people.

The Government plays a key role in this process. But in the end, it is not just about Government policies, but about our collective actions – to nurture an ethos of solidarity and shared responsibility, where every Singaporean contributes and does our part to uplift our fellow citizens. That is how we can confront our challenges with confidence, and keep the Singapore Story going, for many more years to come. Thank you very much.

[1] Data for Singapore is from Department of Statistics Singapore. Data for other economies are from OECD.

[2] TFP data for Singapore is from Department of Statistics Singapore. TFP data for other economies are from OECD.

[3] Comprehensive Labour Force Survey, Ministry of Manpower.

[4] Data for Singapore is from Department of Statistics Singapore. Data for other economies are from OECD.

[5] Ministry of Finance.

[6] Graduate Employment Surveys conducted by the Institutes of Higher Learning.

[7] International Labour Organization and Labour Force Survey, Manpower Research and Statistics Department, Ministry of Manpower.

[8] Source: Department of Statistics.

[9] Estimated using market exchange rates and data from the World Inequality Database.

[10] Solnick and Hemenway (1998).

Explore related topics