SM Teo Chee Hean’s Opening Address at the Global Compact Network Singapore CEO Roundtable

SM Teo Chee Hean

Economy

Environment

Finance

Healthcare

Jobs and productivity

11 November 2020

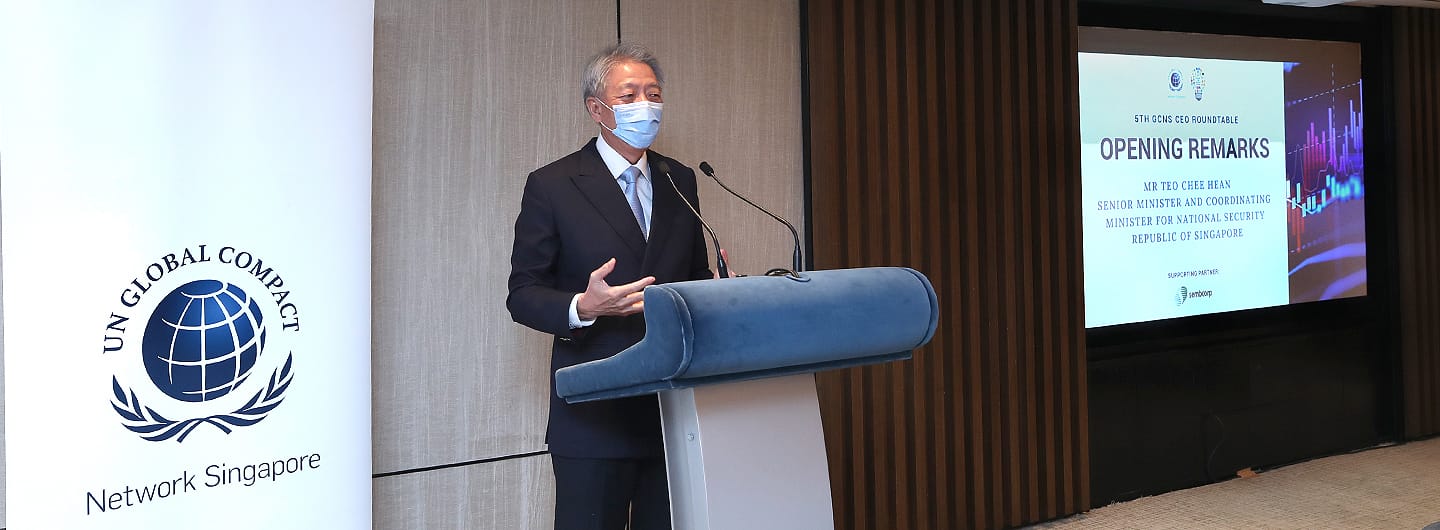

Senior Minister and Coordinating Minister for National Security Teo Chee Hean’s Opening Address at the Global Compact Network Singapore (GCNS) CEO Roundtable at the Shangri-La Hotel on 11 November 2020 at 2.00 PM.

This article has been migrated from an earlier version of the site and may display formatting inconsistencies.

“Building Resilience, Forging Partnerships and Creating Value For a More Sustainable Future”

Ms Goh Swee Chen, President of the Global Compact Network Singapore, or GCNS

Mr Dilhan Pillay Sandrasegara, CEO of Temasek International

Distinguished Guests

Ladies and Gentlemen,

Good afternoon. I am glad to be back at the GCNS CEO Roundtable. I recall attending the 10th GCNS Summit two years ago. I commend GCNS, and all of you, for promoting corporate sustainability and strengthening collaboration among businesses, government and civil society. I am also glad that we are able to resume, at least at some level, physical events and meet face-to-face again, with the requisite safe management measures.

The theme for today is “Leveraging Sustainable Finance to Accelerate Actions for the Sustainable Development Goals (SDGs)”. This is a multi-part statement. Today, I would like to focus on the second and third parts, which are to accelerate actions and the Sustainable Development Goals. In a sense, what actions should we take and what goals do we set for ourselves? If we are clear what our goals are, and what actions we want to take, what kind of sustainable financing is needed becomes clearer. These ideas apply in this case to companies and financial institutions, but they also apply more broadly to each of us as citizens, to the communities and countries we live and operate in, and to the globe that we all share. When we are clear about what goals we seek to achieve, then we can speak about how to get there, including sustainable financing.

Impact of COVID-19

Although the world has seen several crises in recent years, such as the 1997 Asian Financial Crisis and the Global Financial Crisis of 2007-2009, these did not fundamentally change our economic model or the way that we organise ourselves in terms of global trade. There were some speed bumps and changes for precautionary measures, so that we do not end up in the same kind of situation, but essentially the model remained the same - globalisation, technology and greater integration. But COVID-19 has disrupted our way of life. Of course, we cannot attribute everything to COVID-19 because there were pre-existing developments already and COVID-19 accentuated them. These were growing nationalism and technological bifurcation. These developments could be seen as reactions to the developmental model in the world, which included greater globalization and better technological integration. However, people were not comfortable with these trends, because we did not spend enough time thinking about the downsides and negative impacts of these developments that societies needed to ameliorate or mitigate.

With COVID-19, for the first time, we are facing a multiple hit of healthcare, political, economic and social crises with such widespread impact. Many countries, including advanced economies, are struggling to contain the pandemic and provide relief to their citizens. We look to the vaccine with hope. But even when we get there, do we want to go back to where we were before? It is clear that we cannot return to the status quo or business-as-usual – not when countries, businesses and networks are brought to their knees so easily.

There was much talk about how the foreign worker dormitories in Singapore were not well maintained, congested, and became a hotbed for the spread of the virus. But when you look at the numbers, they were not so different than the spread on US and French navy nuclear aircraft carriers, which are top-of-the-line in their field. You cannot say they do not have discipline, good hygiene or good technology. In fact, the ships were designed to fight in an NBC environment – a nuclear, biological and chemical contaminated environment. Except that they were not designed for a biological threat that came from within, not from without. It is really about how you design your system in order to be resilient. Many of us, including many of our cities, were never designed to be resilient to biological threats of this kind.

I would like to touch on three things today. All of them have to do with how we think about time: (i) from “just-in-time” to “just-in-case”; (ii) from short term transactional relationships, to building long term partnerships; and (iii) from looking at value in terms of high frequency indicators such as quarterly results, to how we look at longer term sustainable value.

Let me start with from “just-in-time” to “just-in-case”. Businesses have been relying on “just-in-time” lean enterprise and lean manufacturing strategies. The focus has been on process and resource optimisation – having just enough resources and inventory just in time, to maximise efficiency and reduce costs. But this paradigm depended on everything working all the time, smoothly, everywhere. This does not happen all the time. We have very little buffer to respond to unexpected events and shocks. A lean system may be optimised for a stable operating environment, but it is not resilient – against natural disasters, pandemics, or political upheavals.

The pre-COVID world was already trying to adapt to trade and technology wars, with higher tariff and non-tariff barriers. But the underlying structural change we were all really trying to adapt to was a more fractious and unpredictable world, in which things do not always operate smoothly, in a way that we would like them to, nor in a way we imagined them to in an ideal world. When the pandemic hit, it created a supply shock emanating from China in February, followed by a demand shock as the global economy shut down. This exposed and exacerbated vulnerabilities in supply chains and business models. We have learnt that we cannot just rely on “just-in-time” strategies in the post-COVID world. It is just too dangerous. Each business has to think through how to factor in “just-in-case” to become more resilient. While building resilience could mean higher costs, it has to be balanced against the catastrophic cost of being exposed to a total business shut down or the total collapse of the business.

As experts in your own business sectors, you are best positioned to identify your critical dependencies and vulnerabilities. To do so, it would be useful to identify where the risks are, how long your business can ride out supply and demand shocks, and how quickly a disabled node could recover, be replaced or by-passed. Some of these vulnerabilities may not be immediately apparent as there may be no direct contractual relationship with your companies. Examples include sub-sub-contractors, distribution facilities and transportation hubs. A clear understanding of these will enable businesses to move from “just-in-time” to have a clear-eyed view of what is needed for “just-in-case”.

Second, to move from short term transactional relationships, to building long term partnerships. COVID-19 has shown us how deeply people, businesses and organisations are inter-connected and dependent on one another. We need one another. We have come to take these links for granted. But when we risk losing these links and have to struggle for weeks and months to maintain them, we value these relationships more. All companies work with an extensive network of customers, suppliers, vendors and partners, as well as the communities in which they operate. Investing in longer term partnerships, and treating your partners and the wider community more like extensions of yourselves, will help to take your companies to another level. You build stronger ties and deeper bonds of trust. You explore new opportunities together, take bigger risks together, and tackle challenges together with your partners. You are also good corporate citizens in your communities. In a crisis, you are able to rely on your partners and communities for networks, supplies, know-how and information to plug your knowledge gaps. So, you do get some return on this investment in partnerships. Companies which have not invested in such long-term partnerships may find that they have no one to call on for help in times of need.

The key assets in any company are your people. COVID-19 has focussed greater attention on how companies value your employees as members of your team.

Your employees will remember and appreciate how you had prioritised their health and well-being during the pandemic. They will remember how you had done your best to retain and redeploy them, and where possible, turned the economic downturn into an opportunity to invest in them through training and skills upgrading. Doing so also has its returns. It makes it is easier for you to retain your employees and their core competencies; harness the skills, knowledge, creativity and passion of your team; and to rebuild and position yourself for new opportunities when the economy recovers.

This is something that the government believes strongly in and will work with you and your unions to help you strengthen these partnerships. That is one of the reasons why we adopted the Job Support Scheme, where we give companies money to continue to employ and retain their employees. Rather than a retrenchment and unemployment benefits scheme, where you disassociate the employees’ ability to continue with their daily lives from the company, and the companies lose their teams and it is very hard for them to restart later. We found this particularly so in the Asian Financial Crisis and Global Economic Crisis, when we were able to rebound very quickly. We were able to do so partly because the companies actually maintained their teams. During the rebound, when the orders came back, the companies here who have invested in training, and put the time to restructure and retrain the workers, were able to recover very quickly. Some of their competitors who let their workers go and shut down had to restart and took a much longer time. They also lost time because they did not use the time to reskill and retrain their workers. For us, we took the time, and the government also worked with the companies to provide support and grants to retain the workers and retrain them. This was a better way for the government to use that money, rather than to let the companies make an independent decision to let the workers go, and the government comes in to provide unemployment support. It is a completely different way of approaching the problem.

Third, from “quarterly results” to “sustainable value”. COVID-19 has taught us that companies can no longer focus on short term profits and quarterly results to measure company strength and sustainable value. It is important to pay greater attention to the long-term financial health of your companies, such as sustainable cash flow, leverage and financial reserves. Beyond financial performance, the pandemic has also changed how people define value in business, and what values a company upholds. All these will impact the sustainable value of a company, and its valuation in the long term.

We talked a lot about climate change, which is one very good example. Prior to COVID-19, although there was a general awareness about the impending climate change, many markets continued to favour short term returns from current assets and business lines. They were doing well and giving a good return. Not many were willing to take the steps needed to mitigate the risks from the climate crisis and take advantage of the new opportunities.

Now, as the global economy rebuilds, we all have an opportunity to rethink the future and move towards more sustainable practices. Companies do not only think about where they put their money, and countries have to think about how they should position themselves. Look at where the world is going. China, currently the world’s biggest emitter of greenhouse gases, has announced its target of net-zero emissions by 2060. That is a huge step for them as compared to ten years ago, during the Copenhagen discussion, when they were not ready and would not commit to anything. They have looked at it carefully and decided to make the very significant commitment. In the US, climate change and energy policy will receive renewed emphasis by the new administration. In the European Union, the COVID-19 recovery plan requires member states who ask for the recovery funds to set aside at least 37% for green initiatives and climate projects, and a further 20% for digital transformation. Quite clearly, the EU’s recovery funds are fighting and pushing the countries, and the companies that operate in those countries, to take purview of the future.

This means that more questions will be asked about your companies’ strategies for dealing with mega disruptive trends like climate change, to avoid stranded assets or legacy lines of production that may be rendered obsolete. You may find that the decrease in value happens much more quickly than you would expect. Key stakeholders – shareholders, creditors, customers, and even your employees; people who matter in your business – will demand more in terms of sustainable practices and plans for the long term. If you ask a young, abled person: What is the industry you will go into? Which company will you join? If you are not having good climate practices, they may not join you. That is going to have an impact on the talent growth and the people that you have in your organization. The oil and gas industry, in particular, has already found itself under the spotlight. They know that they are not sitting pretty; COVID-19 has given them a very hard knock as well. But it is admirable that the Big Five oil giants have responded by pledging to reduce emissions. In particular, BP, Royal Dutch Shell and Total have all committed to reach net-zero emissions by 2050. I saw that our neighbour Petronas has also said so. These are all targets that people are reaching for. Even in Singapore, when we look at our petrochemical industry, big oil is not just the staple now. We now have in Singapore the biggest biodiesel plant in the world, and that is Neste. They were already the biggest, and about two years ago they decided to double down on their investment. You would have read that the Japanese airline, ANA, recently signed an agreement with Neste to supply them with sustainable aviation fuel. This is an action which many industries and companies will look to.

The technology revolution will also be a key enabler for new business models. Online shopping has disrupted retail store chains; video conferencing is disrupting traditional work-in-office and travel-to-meet paradigms. These kinds of things have been forced upon us, like COVID-19, and have a huge potential impact on real estate values and business travel. These can enable more efficient, more resilient and more sustainable ways of creating value and the running of businesses.

In the longer term, as we discussed earlier, the quality, loyalty and motivation of your workforce; the strength that you derive from your partnerships with suppliers and customers; and your relationships with your communities, are all important determinants of how we create shared and sustainable value.

The Singapore Government’s Approach

We are not exempted from the same questions that companies are facing. In a way, our responses are not so different. These three areas – just-in-case, building long-term partnerships, and creating sustainable value – are relevant not just for businesses, investors and fund-managers, but also countries and governments. In fact, these are the strategies that the Singapore Government has been pursuing consistently, working together with our partners.

Our “just-in-case” financial reserves, prudently set aside, carefully invested, and protected over many years, have helped us to face the challenge of COVID-19. We do not have to borrow. We drew S$52 billion from our reserves to fund four budgets, amounting to almost S$100 billion, to protect our workers, help our companies, and create new jobs and traineeship opportunities. To respond rapidly and coherently, we drew on our organisational reserves of knowledge, expertise and capacity in our public service and the private sector, especially in our healthcare system which has experience from SARS. We tapped the SAF and Home Team to bring the outbreak in our foreign worker dormitories under control, and to rapidly build up our contact tracing capabilities. We also drew on our reserves of social capital in managing COVID-19, maintaining social solidarity and looking after the vulnerable during the Circuit Breaker and cooperating to enable our safe management measures to work effectively. All these tested the social fabric and resilience of our society.

We want to work with our companies to help you retain your core competencies and invest in our workers for the future as we build back better and stronger after COVID-19. This is why we introduced the Jobs Support Scheme, other than unemployment, to help businesses retain workers and keep teams intact. We have disbursed over S$21.5 billion, benefiting more than 2 million workers. We are shifting from Job Support to Job Growth to create jobs of the future and to prepare our workers for these jobs. We are not in the preservation business; we are in the rejuvenation business. We have established the National Jobs Council to oversee the SGUnited Jobs and Skills Package, to create 100,000 new jobs, traineeships and training opportunities. We also have the SGUnited Mid-Career Pathways Programme, to help our workers to upskill, reskill and emerge stronger from this crisis. None of these is new, because we have been moving along these lines for quite some time. The last one, for mid-career workers, is a very critical element of our strategy. Today, people live and work a lot longer than companies. Therefore, reskilling and retraining are absolutely critical for our society. Failure to do this is one of the reasons why there is a strong reaction towards globalisation and technology transformation in the world. These people have not had the opportunity to see the positive side, which is how they can transition from where they were before and where they can be in the future. This is where the mid-career upskilling is critical for the well-being of individuals in society. Now, we are into the next phase of mass continuing education. We need to think of who pays for it. If Government subsidizes, how do we structure them? There are policy issues and distributional issues on how the costs are shared.

We are well-positioned to be a green growth hub. We want to work with companies to build a green economy – invest in new and green technology and create new green jobs. For R&D, we have set aside over S$20 billion over the next 5 years to support basic and applied research in high impact areas, such as climate change, sustainable cities, energy efficiency, artificial intelligence, and health and biomedical sciences. As an example of what we are doing, we have just launched the S$49 million Low-Carbon Energy Research fund to support research, development and demonstration projects over the next 5 years in technologies such as hydrogen, and carbon capture, utilisation and storage (CCUS). We implemented our economy-wide carbon tax from 2019. We will use the revenue generated to help our companies transform and adopt green practices.

In addition, we will work with financial institutions and companies to advance sustainable finance through our Green Finance Action Plan, including the recently launched Singapore Green Finance Centre, MAS’s grants for sustainable bonds, and loans which are green and sustainability-linked. We are also inviting companies to propose pilot projects that would tap on international carbon credits. This is to help us understand how carbon credit works. There is potential for us to become a carbon credit trading centre. We seek partners among our companies to leverage all these opportunities to create new and sustainable value, and achieve a “green recovery” together.

Conclusion

Singapore believes in building for the future – not just for this generation but for future generations. Stability and continuity in governance and policy have enabled us to formulate long-term plans, and work with our people, businesses and partners to bring our plans to fruition. This is the key to how we have tackled challenges like COVID-19, and built up the resources, resolve and confidence to look ahead to emerge stronger, and build a sustainable future together.

COVID-19 has indeed shocked our systems and changed our world. But this is also an opportunity for countries, businesses, and people everywhere to rethink how we organise ourselves for resilience, collaborate and build long term partnerships, and create sustainable value, so that together, we can emerge stronger, greener and ready for the future.

I know that you will have a fruitful and stimulating CEO Roundtable later. This is a critical turning point that will decide the future of our companies, our people, our country and all over the world. Thank you.

Explore related topics